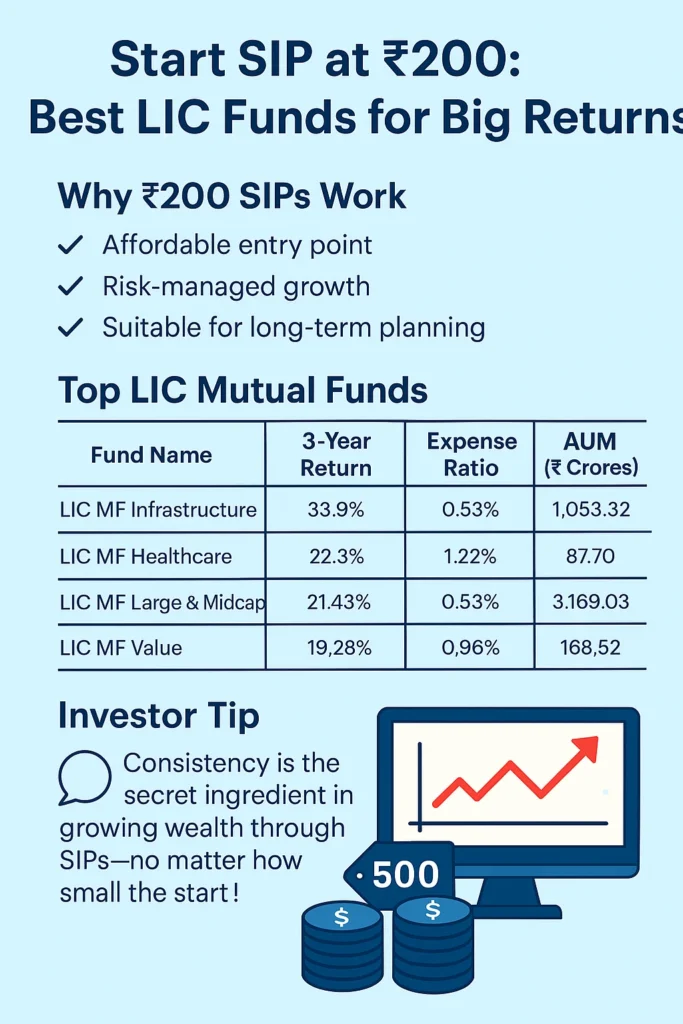

Thinking long term but short on cash? Starting a Systematic Investment Plan (SIP) with just ₹200 might sound too small to matter—but think again. Select LIC Mutual Funds have shown that even tiny monthly contributions can grow into substantial gains, some clocking up to 33.9% return over three years!

Here are four LIC Mutual Funds where low-cost SIPs meet high-performance potential:

💼 LIC MF Infrastructure Fund

- Return (3 Years): 33.9%

- Expense Ratio: 0.53%

- Assets Under Management (AUM): ₹1,053.32 crore A solid bet on India’s booming infrastructure sector, this fund is ideal for long-term growth seekers.

🏥 LIC MF Healthcare Fund

- Return (3 Years): 22.3%

- Expense Ratio: 1.22%

- AUM: ₹87.70 crore Healthcare continues to shine as a defensive and high-growth industry—this fund lets you tap into that potential.

📊 LIC MF Large & Midcap Fund

- Return (3 Years): 21.43%

- Expense Ratio: 0.53%

- AUM: ₹3,169.03 crore A balanced strategy mixing large-cap stability with midcap momentum. Great for moderate risk-takers.

💰 LIC MF Value Fund

- Return (3 Years): 19.28%

- Expense Ratio: 0.96%

- AUM: ₹168.52 crore Focused on undervalued gems, this fund suits contrarian investors who seek smart bargains.

✅ Why Choose ₹200 SIPs?

- Start investing with minimal budget

- Gradually build your portfolio

- Reduced market timing stress

- Best for beginners and cautious investors

Why ₹200 SIPs Work

- Affordable entry point

- Risk-managed growth

- Suitable for long-term planning

Top LIC Mutual Funds

| Fund Name | 3-Year Return | Expense Ratio | AUM (₹ Crores) |

|---|---|---|---|

| LIC MF Infrastructure | 33.9% | 0.53% | 1,053.32 |

| LIC MF Healthcare | 22.3% | 1.22% | 87.70 |

| LIC MF Large & Midcap | 21.43% | 0.53% | 3,169.03 |

| LIC MF Value | 19.28% | 0.96% | 168.52 |

Start small, think big. With consistency and patience, even ₹200/month can become a wealth-building powerhouse.